Table of Content

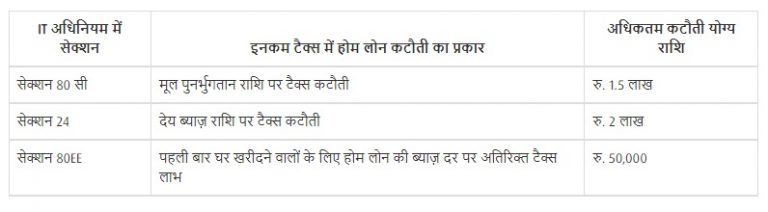

In an action in which it is found that a lender or party charged with a violation has violated this chapter, the court shall award to the debtor the costs of the action and to his attorneys their reasonable fees. In determining attorney's fees, the amount of the recovery on behalf of the debtor is not controlling. "Originator" or "loan originator" means an employee of a mortgage broker or mortgage lender whose primary job responsibilities include direct contact with or informing loan applicants of the rates, terms, disclosure, or other aspects of the mortgage. It does not mean an employee whose primary job responsibilities are clerical in nature, such as processing the loan. Since you are selling the house after holding it for more than 24 months, the profits, if any, made on sale shall be treated as long-term capital gains and you may have to pay on the difference between the indexed cost and the sale price of the property. Please note that if you prepay your home loan then there is no consequence on your tax liability on account of merely prepayment of the home loan, but the same can be claimed under Section 80C up to Rs. 1.50 lakh along with other eligible items.

The pension fund established under subsection shall be invested in securities in which the funds of a pension plan may be invested under the Pension Benefits Standards Act, 1985. Each officer or employee employed by the Corporation shall, before entering on his duties, take, before a justice of the peace or a commissioner for oaths, an oath of fidelity and secrecy in the form set out in the schedule. 11The Executive Committee may exercise the powers of the Board and shall submit at each meeting of the Board minutes of its proceedings since the last preceding meeting of the Board. 9There shall be an Executive Committee of the Board consisting of the Chairperson, the President and three other directors selected by the Board. Subsections to do not apply to the directors referred to in paragraphs and . Penalties not exceeding a fine of seventy two currency points or imprisonment not exceeding three years or both for infringing any provision of the regulations.

Withdrawal of mortgagee from possession

The sick or injured homeowner can also use the forgiveness to cover the property taxes and insurance paid before the debt was transferred to the loan modification program. To cure a default under this Section, a borrower shall not be required to pay any charge, fee, or penalty attributable to the exercise of the right to cure a default, other than the fees specifically allowed by this subsection. After the lender or assignee files a foreclosure or other judicial action or takes other action to seize or transfer ownership of the real estate, the borrower shall only be liable for attorney fees that are reasonable and actually incurred by the lender or assignee, based on a reasonable hourly rate and a reasonable number of hours.

In the case of any high risk home loan, the borrower shall be afforded the opportunity to seek independent review by the Office or the Department of the loan terms, in order to determine affordability of the loan, when and if the General Assembly appropriates adequate funding to the Office or the Department specifically for this Section. Person whom the borrower may contact if the borrower disagrees with the assertion that a default has occurred or the correctness of the calculation of the amount required to cure the default. "Borrower" means a natural person who seeks or obtains a high risk home loan. Using HMDA data, we can learn what happened to the vast majority of those applications and compare that to previous years.

The Federal Home Loan Bank Act Explained in 5 Minutes or Less

Prior to signing a certificate of completion, approved credit counselors shall privately discuss with each attendee that attendee's income and expense statement and balance sheet, as well as the terms of any loan the attendee currently has or may be contemplating, and provide a third party review to establish the affordability of the loan. A lender or a lender's assignee of a high risk home loan that has the legal right to foreclose shall use the judicial foreclosure procedures provided by law. In such a proceeding, the borrower may assert the nonexistence of a default and any other claim or defense to acceleration and foreclosure, including any claim or defense based on a violation of the Act, though no such claim or defense shall be deemed a compulsory counterclaim.

In the wake of the stock market crash of 1929, thousands of panicked Americans emptied their savings and checking accounts, causing a series of bank runs that caused many financial institutions to collapse. The Federal Home Loan Bank Act brought stability and credibility to the loan industry, stimulated the housing industry, and established a precedent for federal oversight and regulation of economic matters. The 11 Federal Home Loan Banks still operate today, providing low-interest loans, grants, and other subsidies to financial institutions. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance.

Application of proceeds of sale of mortgaged land

A financial institution joins the FHL Bank that serves the state where the business is located. The Financial Institutions Reform, Recovery, and Enforcement Act revamped regulations for savings and loans and real estate appraisals in 1989. The Federal Home Loan Bank System established by the act is still in effect today.

By virtue of their GSE status, the FHLBanks are able to borrow in the capital markets at favorable rates . The FHLBanks then pass along that funding advantage to their members—and ultimately to consumers—by providing advances and other financial services at rates that the member financial institutions generally could not obtain elsewhere. That, in turn, enables these banks to make financing more available to borrowers. A person appointed as President or as a director from outside the federal public administration who fails to comply with subsection ceases to hold office. Is employed in any capacity in the federal public administration or the public service of a province or holds any office or position for which a salary is payable out of public moneys, but nothing in this paragraph prohibits such a person from holding office while performing temporary services for the Government of Canada or of a province. Unless otherwise allowed under federal law, a consumer home loan agreement may not contain a choice of law provision identifying a state other than South Carolina.

In an effort to restore faith in the banking system, it established the Federal Deposit Insurance Corp. , which insured individual bank deposits in case of an institution’s failure. The Corporation may on its own behalf employ such officers and employees for such purposes and on such terms and conditions as may be determined by the Executive Committee and such officers and employees are not officers or servants of Her Majesty. The President on the expiration of his or her term of office may, if eligible, be re-appointed. The President shall be appointed by the Governor in Council to hold office during pleasure for such term as the Governor in Council considers appropriate. 3There is hereby established a corporation to be called the “Canada Mortgage and Housing Corporation” consisting of the Minister and those persons who compose the Board of Directors. The HELPER Act stands for "Homes for every local Protector, Educator, and Responder." This bill aims to provide our local law enforcement, fire-fighters, EMS, and K-12 Educators more affordable mortgage financing.

In short, the FHLBs act as “banks to banks.” FHLBs also provide secondary market outlets for members interested in selling mortgage loans, as well as specialized grants and loans aimed at increasing affordable housing and economic development. Architects of the Federal Home Loan Bank Act intended it to inject money into the banking system and make mortgage loans available to consumers, thereby stimulating the housing and real estate markets. On November 21, 2013, Rep. Steve Stivers introduced the bill To amend the Federal Home Loan Bank Act to authorize privately insured credit unions to become members of a Federal home loan bank (H.R. 3584; 113th Congress) into the United States House of Representatives. The bill would amend the Federal Home Loan Bank Act to treat certain privately insured credit unions as insured depository institutions for purposes of determining eligibility for membership in a federal home loan bank.

Where a person holds out to be providing independent advice as provided for under section 6, such a person shall be liable on conviction to a fine not exceeding one hundred twenty currency points or to imprisonment not exceeding sixty months or both. May take such other steps in addition to the steps set out in this section as he or she considers necessary and desirable to satisfy himself or herself that the assent of the spouse or spouses is informed and genuine. The majority of the banks showed declining volumes compared to the quarter before. Mortgage-purchase applications were 4.6% higher in December from a month ago, per a Redfin report. Some companies are making them available for a broader range of mortgage products, and one also offers a future no-fee refinance option.

Modeled on the Federal Reserve System, it established a regulatory agency, the Federal Home Loan Bank Board , to create and oversee a network of member Federal Home Loan Banks . She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT executive and professor for 34 years. She is an adjunct professor at Connecticut State Colleges & Universities, Maryville University, and Indiana Wesleyan University. She is a Real Estate Investor and principal at Bruised Reed Housing Real Estate Trust, and a State of Connecticut Home Improvement License holder. The ABA Compliance Network is a members only online forum facilitating discussion of compliance topics and providing opportunity for professional interaction.

By the mid-1930s, the HOLC had refinanced nearly 20% of urban homes in the country. "Obligor" means each borrower, co-borrower, cosigner, or guarantor obligated to repay a loan. "The Law and Macroeconomics of the New Deal at 70." In Maryland Law Review 62, no. 3 . Consisting of twelve regional FHLB banks and the Federal Home Loan Bank Board in Washington, D.C. The provisions of this Act are severable under Section 1.31 of the Statute on Statutes.

No comments:

Post a Comment